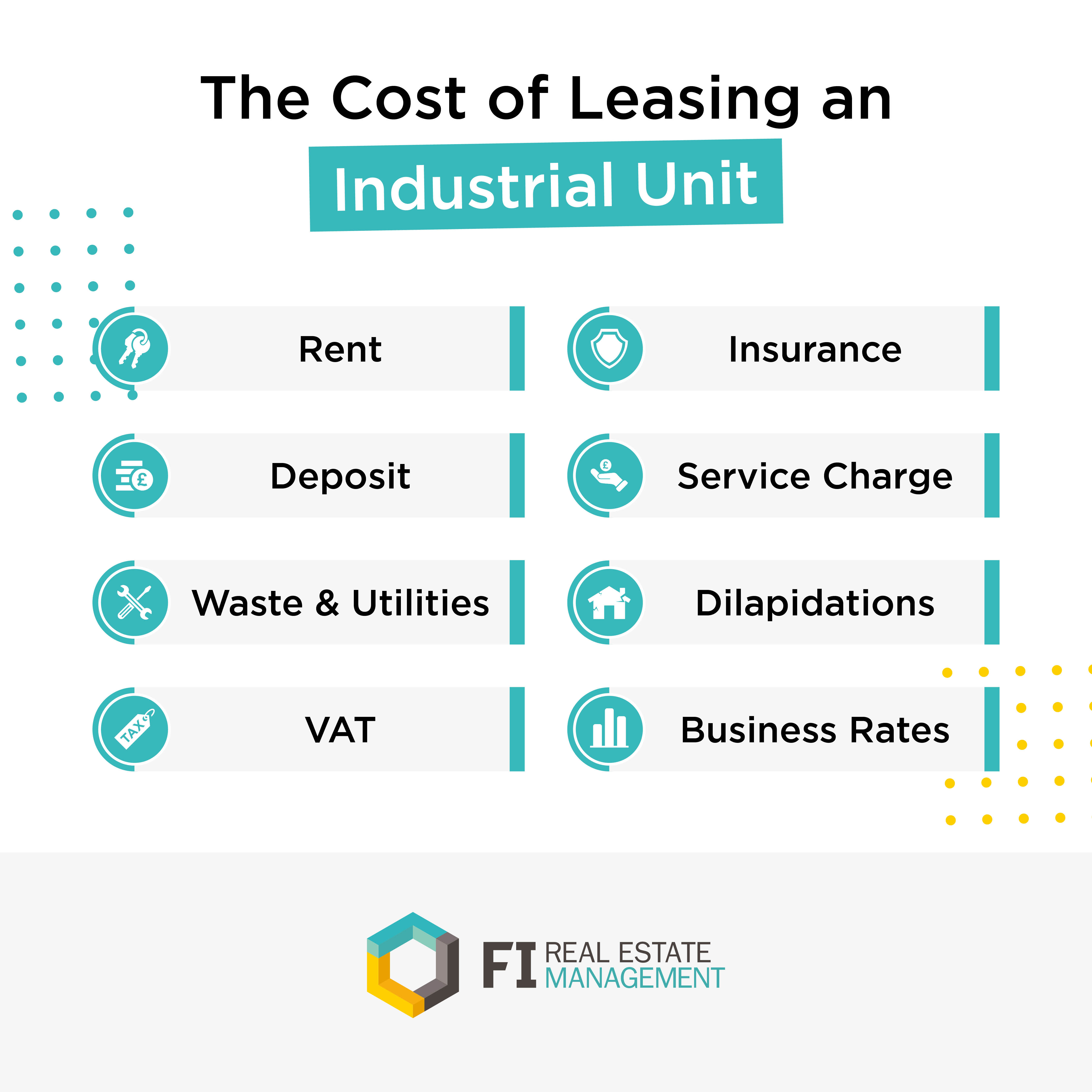

In an ideal world, leasing an industrial unit would be as simple as paying a set single amount each month. However, the reality isn’t as straightforward as that.

Anyone who hasn’t taken industrial space before will be curious about the various changeable outgoings involved - we’re about to list them right now.

Rent

Let’s start with the big one. Rent is perhaps the most obvious cost you can expect to pay when occupying any space.

It’s perhaps the most predictable cost too because during the negotiation stage and ahead of signing the lease, you’ll have agreed and laid out each regular rent payment, along with any scheduled rent rises.

Rent is the result of various factors including the size of the unit, its location and condition, the length of the lease, and market demand.

Insurance

Landlords will insure the building on your behalf and pass on the cost to you, but you’d need to obtain your own insurance for contents and public liability.

At FI Real Estate Management, we can call upon our list of dependable suppliers to ensure you’re suitably covered.

Deposit

Another cost to budget for is the deposit. This can be the equivalent of anything from three to six months’ rent and is typically paid before you get the keys when a lease begins.

Service Charge

Also known as a ‘maintenance charge’, a service charge helps contribute towards the estate’s upkeep, security, and signage.

In some leases, the service charge may be bundled into an inclusive rent, or it might be the case that the tenant pays an additional charge on top of the basic rent.

Whichever way it works out, these charges can cover:

- repairs and maintenance to the building’s surrounding area

- the management of repairs and maintenance

- management of the lease

- provision of concierge and warden

Waste & Utilities

It’s hard to imagine many industrial units not needing water and electricity. Fortunately, we can spare you another round of contract negotiation at FI Real Estate Management, again thanks to our links with reliable, high-quality providers.

Dilapidations

If the unit’s condition has deteriorated during your tenure, it’s common practice to be charged to return it to the state in which it was let.

VAT

Leasing an industrial unit would be liable to VAT at the standard rate of 20% of the monthly rent.

Business Rates

Paid each month, business rates generally clock in at around 50% of the charged rent.

All commercial tenants pay business rates to the Government and they differ depending on where you’re leasing space, so get in touch with the area’s local authority to clarify what you can expect to pay in business rates.

Any property with a rateable value (RV) of £12,000 or less is exempt from business rates, while properties with an RV of between £12,001 and £15,000 benefit from a sliding relief rate.

For instance, if the rateable value is £13,500, your business rate bill is halved, while a property with a £14,000 rateable value sees business rates reduced by 33%.

Even if you obtain a second property, you can continue to enjoy business rate relief on your first property as long as none of your other properties have a rateable value above £2,899 and the total rateable value of all your properties is less than £20,000 (or £28,000 in London).

With an industrial portfolio spanning 6m sq ft throughout the UK, chances are high that we have the unit for you at FI Real Estate Management.

You’ll gain more than just a space to do business too; you’ll benefit from the support of a dedicated team of asset managers who can routinely check in to ensure you’re receiving first-rate service.